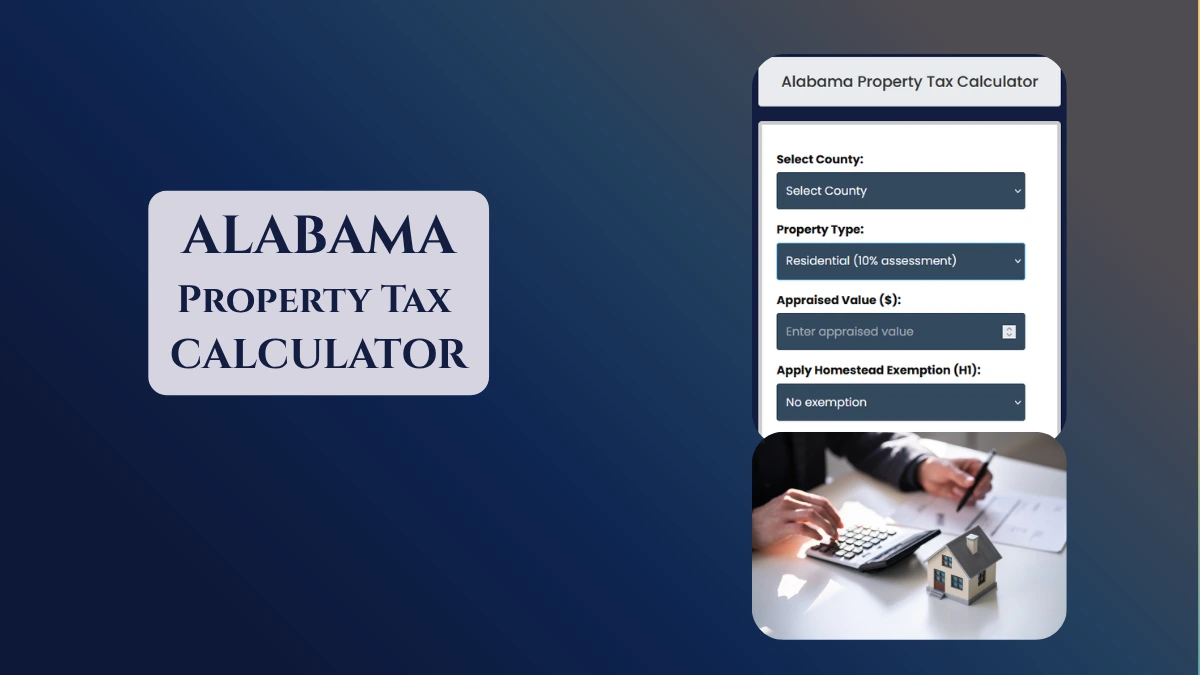

For homeowners and investors, the Alabama property tax calculator is an essential tool that helps estimate annual property tax obligations based on property value, millage rates, and applicable exemptions.

Knowing how is property tax calculated in Alabama state for each wise allows you to budget accurately and avoid surprises when tax bills arrive. Let’s check on estimator:

Alabama Property Tax Calculator

How is Property Tax Calculated in Alabama?

- Assess Property Value: The county assessor determines the market value of your property. In Alabama, residential property is assessed at 10% of its market value, while commercial property is assessed at 20%.

- Apply Exemptions: Common exemptions include the Alabama homestead exemption, which reduces taxable value for primary residences. Additional exemptions exist for seniors, veterans, and the disabled.

- Calculate Assessed Value: Multiply the market value by the assessment rate, then subtract exemptions.

- Apply Millage Rate: Multiply the assessed value by the local millage rate (expressed as mills per dollar). Millage rates vary by county and municipality.

- Determine Final Tax: The result is your annual property tax bill. County Revenue Commissioner website or approach directly.

Example Calculation

Suppose your home’s market value is $200,000 in Jefferson County:

- Assessed value: $200,000 x 10% = $20,000

- Homestead exemption: $4,000

- Taxable value: $20,000 – $4,000 = $16,000

- Millage rate: 66 mills (or $0.066 per $1)

- Annual tax: $16,000 x 0.066 = $1,056

Alabama State Property Tax Rates by County

Millage rates differ across Alabama’s 67 counties. For example:

- Jefferson County: ~66 mills

- Madison County: ~48 mills

- Mobile County: ~42 mills

Check your county revenue commissioner’s website or use the Alabama property tax calculator online for the latest rates.

Alabama State Property Tax Exemptions

Homestead Exemption

The Alabama homestead exemption can significantly reduce your property tax if the property is your primary residence. Seniors (65+), disabled persons, and veterans may qualify for additional exemptions.

Other Exemptions

- Disabled veterans: Up to 100% exemption

- Senior citizens: Additional reductions based on income and age

- Nonprofit and religious organizations: Special exemptions

Special Scenarios: Investors, Commercial Properties, and Relief Programs

- Investors: Alabama property tax for investors is calculated at a higher assessment rate (20%).

- Commercial Properties: Use a property tax calculator for Alabama commercial real estate to estimate taxes at the correct rate.

- Relief Programs: Seniors, veterans, and low-income homeowners may qualify for property tax relief programs in Alabama.

Alabama Property Tax Assessment

Assessment notices are mailed annually. If you disagree with your property’s assessed value, you can file an appeal through your county’s property tax appeal process. Understanding Alabama property tax assessment notices is crucial to ensure fair taxation.

Alabama State Property Tax Deadlines and Payment Options

- Due Date: Property taxes are due October 1 and delinquent after December 31.

- Payment Options: Online, by mail, or in person at your county revenue office.

- Penalties: Late payments incur penalties and interest. Avoid delinquent property tax in Alabama by paying on time.

How Property Tax affects Home Buying in Alabama

Property taxes impact your total cost of homeownership. Use the Alabama Property Tax Calculator to estimate annual taxes before purchasing.

How to Appeal Property Tax Assessment in Alabama

If you believe your property is overvalued, file an appeal with your county’s board of equalization within 30 days of receiving your assessment notice.

Using the Alabama Property Tax Calculator empowers you to estimate your taxes, understand exemptions, and plan for deadlines, ensuring you’re prepared for all aspects of property tax in Alabama.