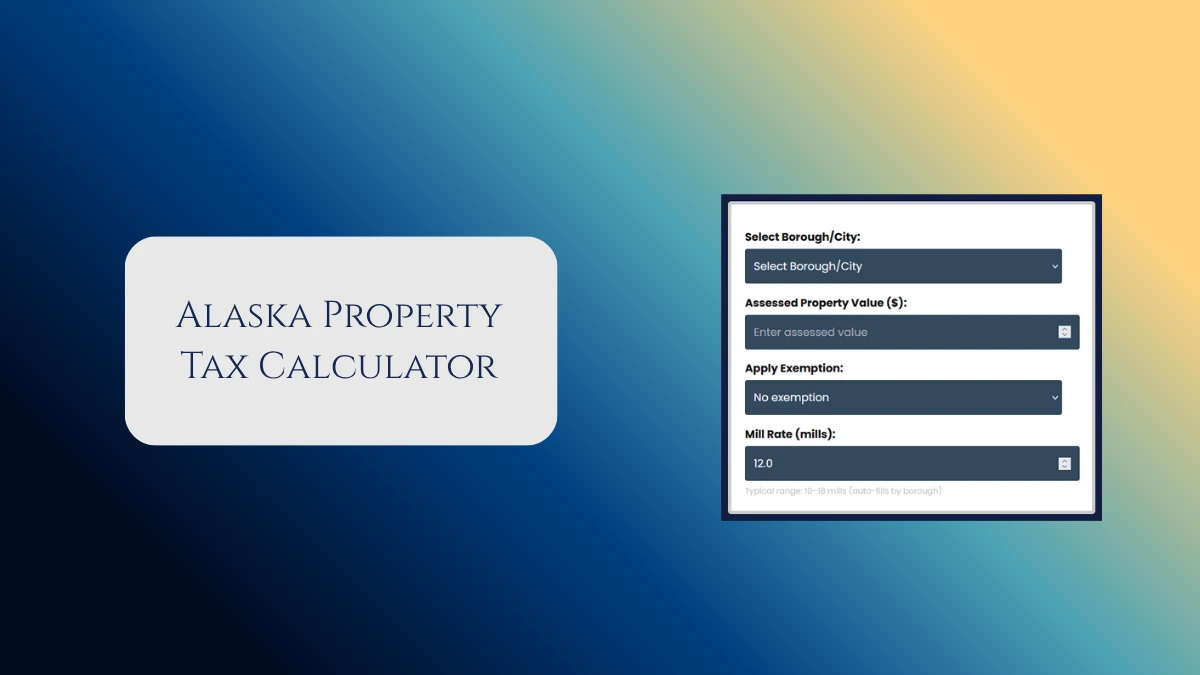

Alaska Property Tax Calculator with Rates, Exemption and Estimation

Property owners searching for an Alaska Property Tax Calculator want a clear, accurate way to estimate their annual tax bill and understand the factors that influence property taxes in Alaska. This guide covers how property tax is calculated in Alaska, current rates, available exemptions, and step-by-step instructions for calculating your tax liability empowering homeowners, buyers, and investors across the state. Alaska Property Tax Calculator Alaska ...