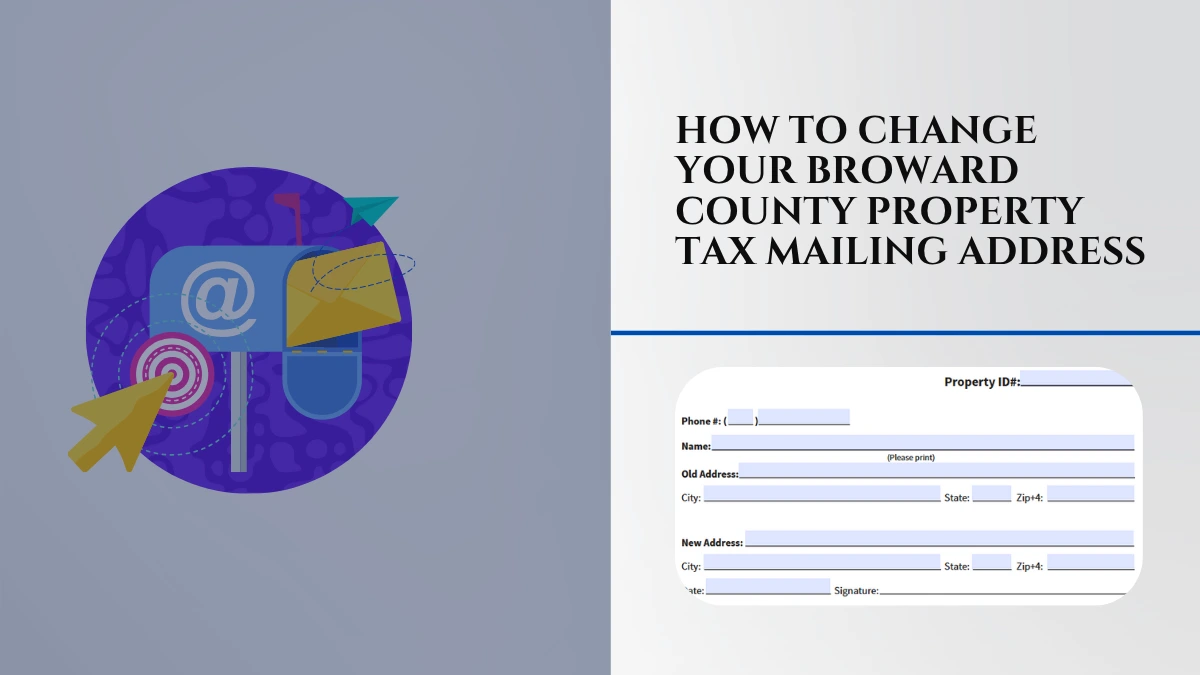

How to Change your Broward County Property Tax Mailing Address

Managing and change your Broward County property tax mailing address is crucial for every property owner to ensure you receive timely tax notices, exemption updates, and other critical communications from the Broward County Property Appraiser’s office. Failing to update your address can lead to missed notices and potential penalties on Broward County property tax payment, so make it essential to promptly inform the office of ...