Paying property tax monthly with Easy Smart Pay is now available for homeowners across numerous California counties including Alameda, Calaveras, Colusa, Contra Costa, Del Norte, El Dorado, Glenn, Humboldt, Kern, Kings, Los Angeles, Lake, Madera, Mariposa, Modoc, Mono, Monterey, Napa, Nevada, Plumas, Riverside, Sacramento, San Joaquin, San Mateo, Shasta, Sierra, Siskiyou, San Luis Obispo, Solano, Sonoma, Stanislaus, Tehama, Trinity, Tulare, Tuolumne, and Yolo.

This innovative solution helps property owners manage their annual tax obligations through manageable monthly installments, rather than facing large lump-sum payments twice a year.

What is Easy Smart Pay?

Easy Smart Pay (ESP) is a secure, third-party platform that partners with county governments to streamline property tax payments.

ESP allows property owners to split their annual or biannual property tax bill into equal monthly payments.

The service is not a lender or bank, and it simply collects your monthly payments and remits the full amount to your county tax collector before each official deadline.

Key Features and Benefits of Easy Smart Pay for Property Tax

- Available in Multiple Counties: ESP is accepted by dozens of California counties, making it a widely accessible option for property owners statewide.

- Monthly Installments: Break your property tax bill into predictable monthly payments, easing budgeting and cash flow management.

- Low Transaction Fees: ACH (bank account) payments are free, while credit/debit card transactions incur a low 1.99% fee among the lowest in California.

- Automatic Payments: Set up auto-pay to ensure your taxes are always paid on time, with reminders and tracking provided through your ESP account.

- Secure and Private: ESP uses advanced encryption and does not store or sell your personal or credit card information.

- Automatic Renewal: After your first year, ESP auto-enrolls you for the next tax cycle, providing a seamless, ongoing monthly payment experience.

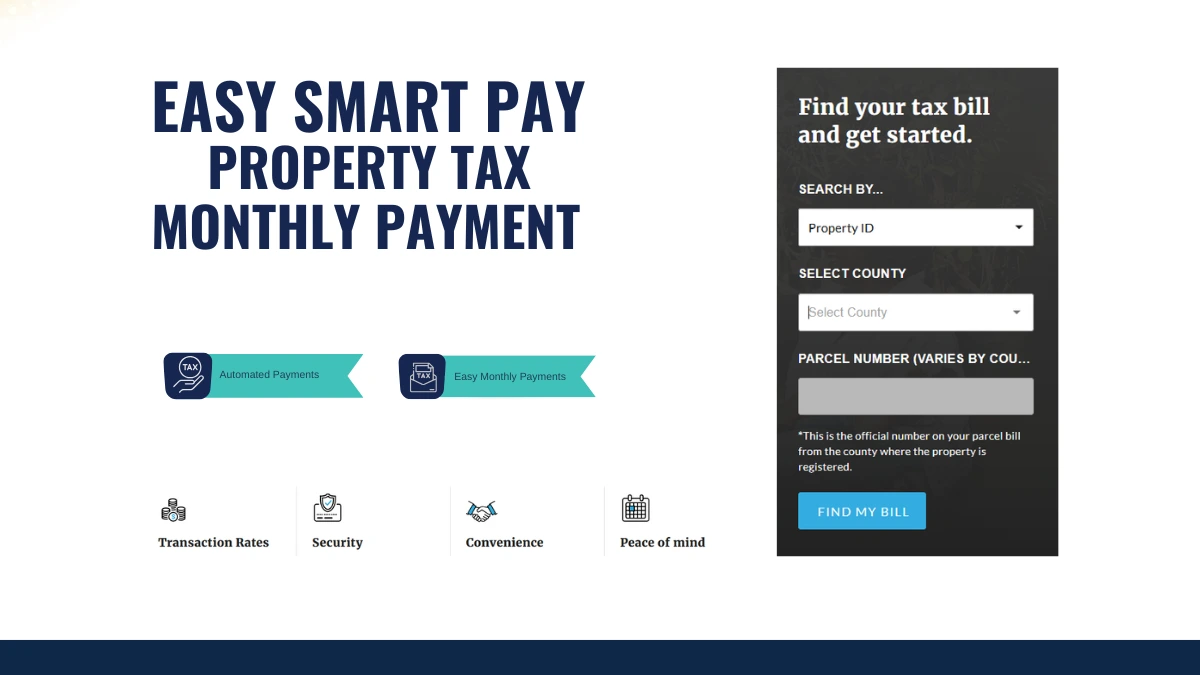

How to Set Up Easy Smart Pay Monthly Property Tax Payments

- Visit Easy Smart Pay (ESP) website at https://easysmartpay.net/

- Select the Search type either Property ID or Address

- If Selected Property ID

- Select your county from the list of participating counties.

- Enter your 12 digit APN.

- If Selected Property Address.

- Enter the Address in Property Address space.

- If Selected Property ID

- Click on Find My Bill.

- Enter your property address or tax bill information to locate your account.

- ESP calculates your monthly payment amount based on your total tax bill and the number of months until the next county deadline.

- Register with your contact and payment information, if required.

- Select ACH for no fee, or use a credit/debit card for a 1.99% transaction fee.

- Confirm your details and submit your enrollment. ESP will send you email notifications at each step.

- ESP ensures your property taxes are paid on time, before the county’s official deadlines.

- After the current tax year, ESP will automatically set up your monthly payments for the next cycle, providing uninterrupted service.

Important Considerations:

- Due Dates Remain Unchanged: ESP ensures your taxes are paid to the county before the standard deadlines, but you must have paid enough through ESP to avoid penalties.

- Not for Supplemental Taxes: ESP covers regular secured property taxes, not supplemental or special assessment bills.

- No Lending or Advances: ESP is not a loan service; it simply divides your existing bill into monthly payments and pays the county on your behalf.

- Customer Support: For questions, contact Easy Smart Pay directly on Email: [email protected] or at Phone: (916) 9133279 or refer to your county’s tax collector website for more information.

Alternatives to Easy Smart Pay

- Impound Account: Some homeowners can include property taxes in their monthly mortgage payment through an impound account managed by their lender, often at no additional cost.

- Personal Savings Plan: You can set aside money monthly in a dedicated savings account to cover property taxes when due, potentially earning interest in the process.

Why to Use Easy Smart Pay for Property Tax Monthly Payments?

ESP is ideal for homeowners who prefer regular, smaller payments over large, infrequent bills.

With its wide county coverage, low fees, and automated features, ESP makes it easier for California state property owners in any county will stay current on their tax obligations without stress.

Managing your property tax monthly with Easy Smart Pay can help you avoid late fees and maintain steady control over your household finances.

Riverside county property tax monthly is central to this flexible payment approach, helping homeowners stay on top of their financial obligations throughout the year.